401k loan calculator fidelity

Web If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts. Web Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each.

Fidelity Go Review Smartasset Com

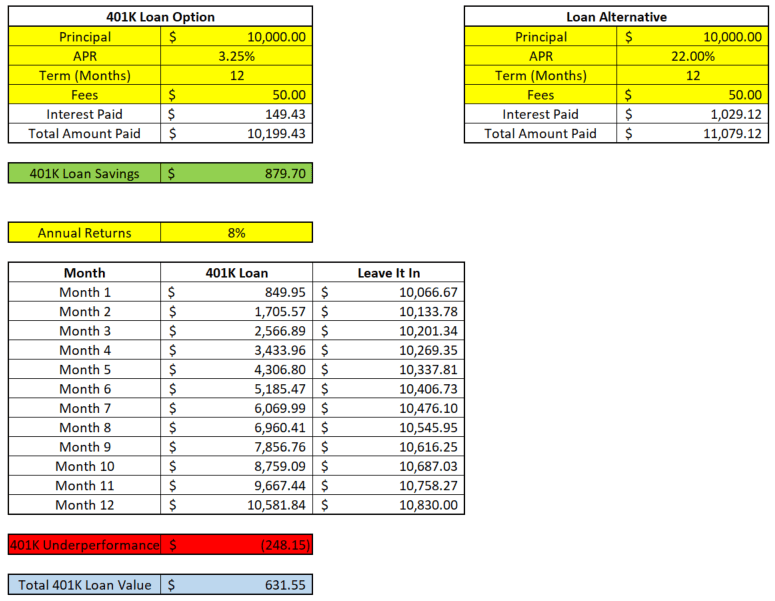

Please be advised that these are indicative amounts.

. Best Loan Options From More Lenders. Web Use this 401k loan calculator to help calculate your 401k loan payments. Your payments add up to 3234367.

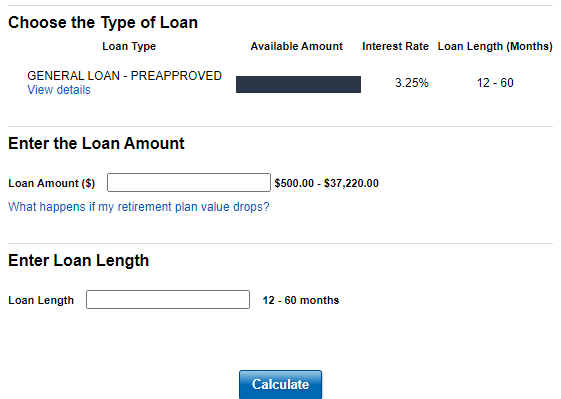

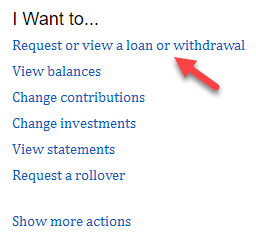

Use this calculator to determine payment and interest amounts for loans. Web How To Apply For A Loan. Option for upgraded account that includes free wire transfers checks tax form filing and other features.

Use the Contribution Calculator. Web For more information or questions please contact us by phone at 1-800-388-4380 or email us at Fidelity at fddbank dot com Footer Information Call Us. Web For example lets assume your employer provides a 50 match on the first 6 of your annual salary that you contribute to your 401 k.

Web Obtain an estimate of what you could afford to borrow with a Fidelity Personal Loan. Web Complete a Self-Employed 401 k Account Application for yourself and each participating owner including the business owners spouse if applicable. Ad Premier Business Loan Marketplace.

401 k College Planning Estate Planning. You would be able to make 114 Monthly withdrawals in the amount of 100000 and one final withdrawal of 92045. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state.

Loans Up To 500k. Web Calculator Results. Get Offers From Top 7 Online Lenders.

Web Using this 401k early withdrawal calculator is easy. Loans Up To 500k. Web Be Informed About Your Loan.

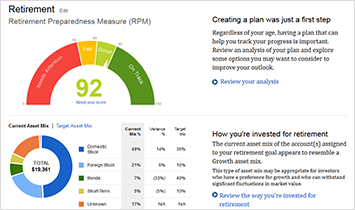

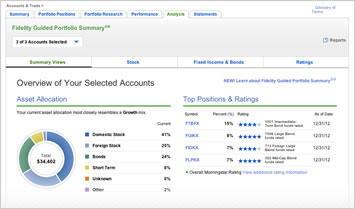

Web The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place. Web Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance. The total of payments includes interest of 234367 over the life of the loan.

If you have an annual salary of 100000. Web Support for 401 loans and Roth contributions. This 401k loan calculator works with the user entering their.

Your loan payment will be 53906. Current faculty and staff who are a participant in the Plan are eligible to take a loan against their voluntary pre-tax account balance held at. Ad Need a Business Loan.

How This 401k Loan Calculator Works. Web Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance. Use the Contribution Calculator.

This easy-to-use interactive calculator helps you quickly bucket expenses and determine your monthly surplus or deficit. With this tool you can see how prepared you may be for retirement.

Listing Of All Tools Calculators Fidelity

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Financial Calculators Tools Fidelity

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

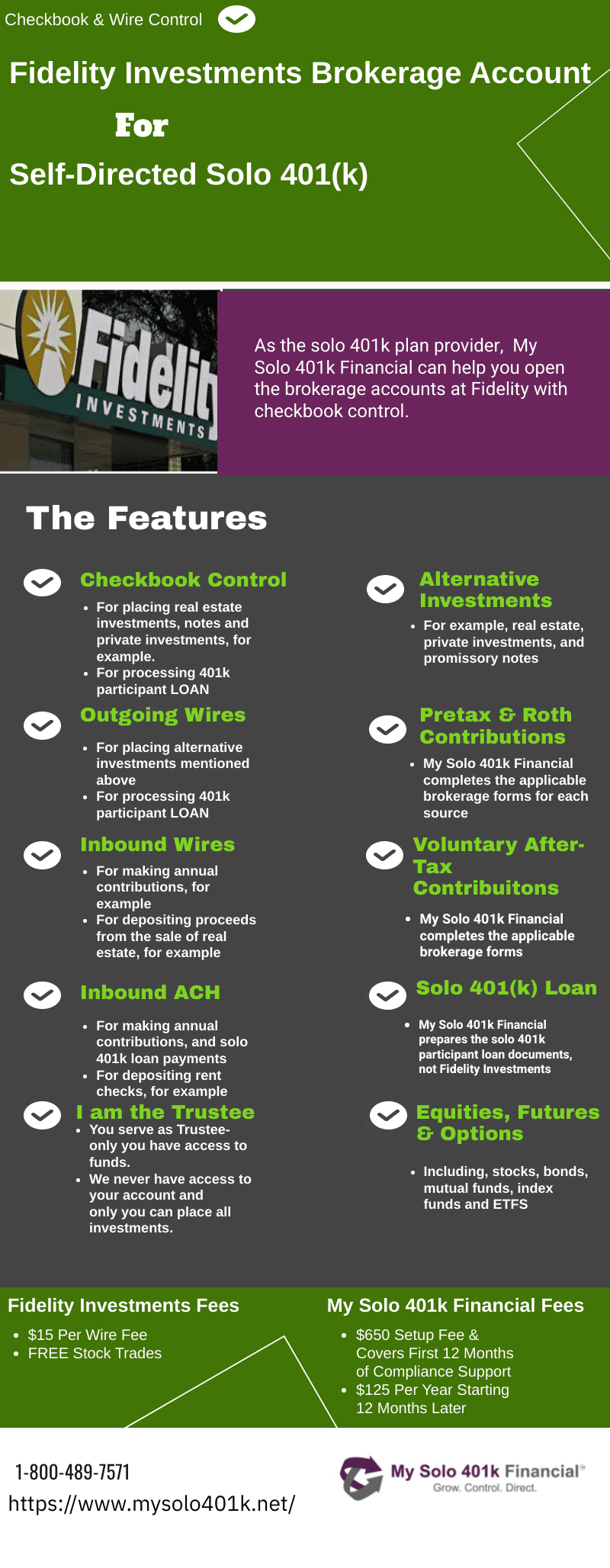

Fidelity Solo 401k Brokerage Account From My Solo 401k

Fidelity Solo 401k Brokerage Account From My Solo 401k

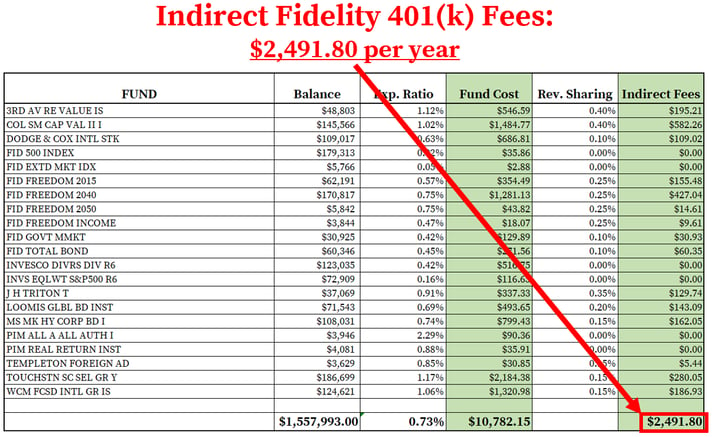

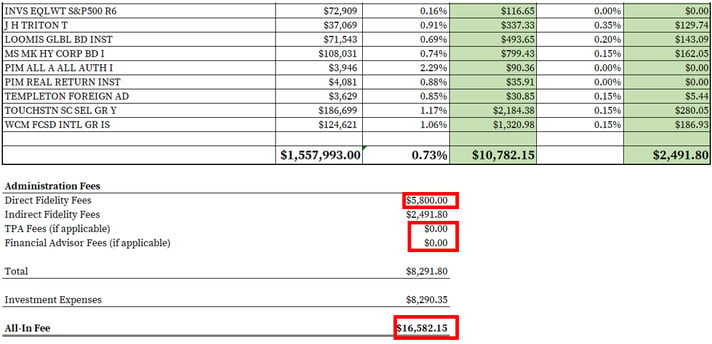

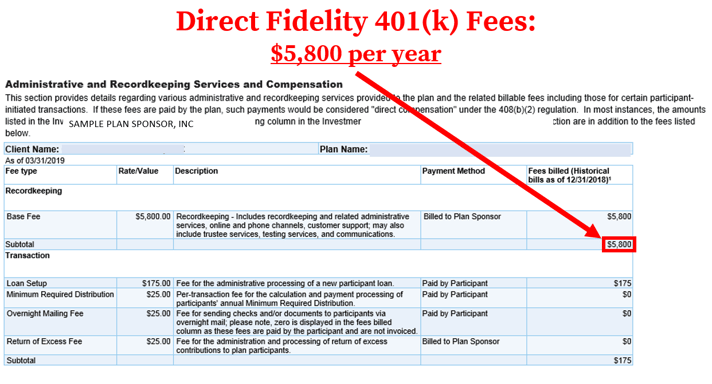

How To Find Calculate Fidelity 401 K Fees

Fidelity Solo 401k Review Top Reasons To Change To A Self Directed Solo 401k Youtube

Fidelity And Bitcoin Is Crypto Actually Coming To 401 K S Money

Fidelity Investments Review Weigh The Pros And Cons Money

How To Find Calculate Fidelity 401 K Fees

Listing Of All Tools Calculators Fidelity

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

Fidelity Self Employed 401 K Form Fill Out Printable Pdf Forms Online

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

How To Find Calculate Fidelity 401 K Fees